Content

Unlike the operating section, the non-operating section is not split into subcategories. It simply lists all of the activities and totals them at the bottom.

An income statement is one of the most basic but necessary accounting documents for any company. Learn what income statements are, their purpose, and examine their components of revenue and expenses. Since it is concise and uses just one equation, the single-step income statement is very easy to read. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. A single-step income statement offers a simple accounting method for the financial activity of a business, making it easy to prepare and understand.

Cost of sales

Income before taxes includes operating income, but also other streams of income/expenses. This might include gains or losses from disposals, interest income, or dividend income. For example, the firm may have some financial investments which it earns interest on. A small business that has a simple operating structure, such as partnerships or sole proprietorships, could use either single-step or multi-step income statements. Gross profit is found in the top part of the multi-step income statement. First, you need to calculate net sales (the sum of a company’s sales minus returns, discounts, and allowances).

- All revenue streams are simplified and compiled in one section, with all expenses allocated separately.

- This could be due to the matching principle, which is the accounting principle that requires expenses to be matched to revenues and reported at the same time.

- Match the items below by entering the appropriate code letter in the space provided.

- Non-operating items, including non-operating revenues, non-operating expenses, and non-operating gains , are shown separately from operating revenues and operating expenses.

- Remember to include things like interest and transactions around investments.

The best choice for a given company depends on the type of business it is and what it intends to use the income statement for. – This is used when the Multi-Level income statement uses combined operations, and each Multi-Level Income Statement uses different periods. However, for management reporting, If the management wishes to go into detail, a Multi-step Income statement is beneficial. However, the company can define a reporting period based on project duration in a very rare occurrence.

Income Statements For Merchandising Vs Service Companies

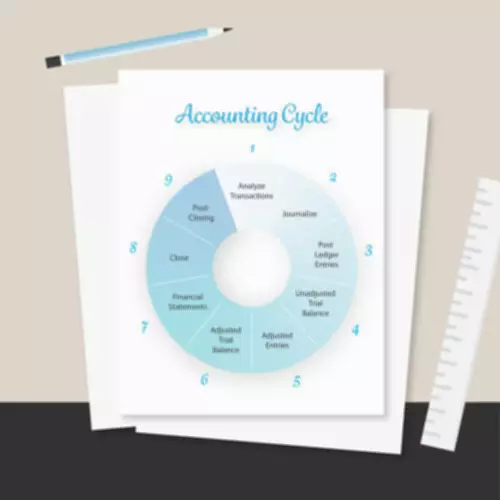

Multi-step income statements follow a three-step process to calculate net income. The preparation for non-operating expenses is slightly less complex as it only includes revenues and expenses https://www.bookstime.com/ from non-operating items. Remember to include things like interest and transactions around investments. The income statement can come in two main formats – single-step, or multiple-step.

- The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement.

- The income statement shows a companies revenue, expenses, and profit.

- As the name indicates, a multi-step income statement shows multiple steps in Income Statement.

- When you apply for a loan, you’re required to submit a multi-step statement.

- Multi-step income statements also aid income projection models.

The multi-step income statement provides businesses with detailed information on their business health and profitability. One of the top three financial statements, the income statement measures company performance.

Types of Businesses using Multi-Step Statements

In preceding chapters, we illustrated the income statement with only two categories—revenues and expenses. In contrast, a multi-step income statement divides both revenues and expenses into operating and nonoperating items. The statement also separates operating expenses into selling and administrative expenses. A multi-step income statement is also called a classified income statement. Before you prepare your income statement, you need to select a reporting period. Typically, income statements are prepared monthly, quarterly or annually. Publicly traded corporations are required by law to prepare financial statements both quarterly and annually.

It’s one of the three major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement. A single-step income statement offers a simple report of a business’s profit, using a single equation to calculate net income.

Common Size Analysis Income Statement

However, if it wants to show the gross profit on the hardware sales and the operating expenses separately, it would use the income statement example multi-step income statement. The multi-step income statement includes multiple subtotals within the income statement.

- Thus, statement users can see how much expense is incurred in selling the product and how much in administering the business.

- Multi-step income statement items include revenue, cost of goods sold, and expenses, which are calculated to arrive at net income.

- An example of a single step income statement is Dana Incorporated’s Consolidated Statement of Operations for the calendar years ended December 31, 2021, 2020, and 2019.

- Expressed as a percentage, the net profit margin shows how much of each dollar collected by a company as revenue translates into profit.

- Similarly, once you have a net income, you could also calculate comprehensive income.

- These total expenses can then be subtracted from gross profit to arrive at the operating income.

Many financial decisions do require more information about a business’s financial health than net income alone can provide. When assessing a business’s financial performance to assist in making such decisions, the single-step format will not be the most beneficial format. Your choice of format depends on what you intend to use your income statement for, and what level of financial detail you’re intending to provide. An income statement helps business owners decide whether they can generate profit by increasing revenues, by decreasing costs, or both. It also shows the effectiveness of the strategies that the business set at the beginning of a financial period. The business owners can refer to this document to see if the strategies have paid off.

Different Types Of Income Statements

The name of the company appears first, followed by the title “Income Statement.” The third line tells the reader the time interval reported on the profit and loss statement. It’s the statement that lists the revenues and expenses for the business for a specific period. Revenues are listed first, and then the company’s expenses are listed and subtracted. If revenues were higher than expenses, the business had net income for the period. As such, you’ll only find two sections on a single-step income statement.

The income statement should contain subtotals allowing for analysis of operations. Net sales is the first amount shown on the income statement of a retailer, manufacturer, or other companies which sell products. In other words, sales are generally the main operating revenues for companies selling goods. Typically, those who produce or sell goods use multiple-step income statements because there is a greater need to understand the differences between operating and non-operating transactions.

Contribution Margin Income Statement

Instead, by allocating a percentage, investors can compare how much of a firms revenue is being spent on cost of goods or operating costs. From the example income statement above, we can see that revenue amounted to $55,245,000 . This figure is how much the company sold within the reporting period. Whilst the balance sheet looks at a firms financial stability, the income statement looks at the firms profitability. The most common format for the income statement is the multiple-step which segments expenses between ‘cost of goods’ and ‘operational expenses’. Yet, a single-step income statement could still provide all of the information a small business would need to see how it is doing.

- This is an example of an income statement and shows some of the common items you’ll find on an income statement.

- Once your method is selected, you’ll need specific information from the income statement, balance sheet, accounts, or journal entries, depending on your method.

- It differentiates the operating and non-operating incomes and expenses, which ultimately shows earnings from main business activities as compared to non-essential activities.

- We will look at the income statement only as the other statements have been discussed previously.

- This number can be pulled from your company’s accounting system.

- Another useful income figure calculated by the multi-step format is operating income.

- Your choice of format depends on what you intend to use your income statement for, and what level of financial detail you’re intending to provide.